Think tank the International Longevity Centre – UK (ILC-UK) has calculated that the base rate should be lower than it is, despite criticism from a number of quarters in recent weeks that the Bank of England’s policy of quantitative easing and the ultra-low base rate have unnecessarily eroded returns for savers.

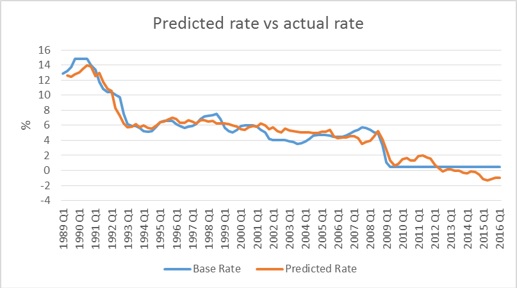

In its latest Economics Insight paper, economists at the ILC-UK applied a simple Taylor Rule to estimate the statistical relationship between the historic base rate and a one quarter lag of inflation and unemployment. These two economic variables explain 93% of the variation in the base rate since 1989 (a very strong fit).

The analysis suggests that, based on the historic relationship between these economic fundamentals and the base rate, the base rate should be even lower than it currently is (around -1%).

Source: Author’s calculations based on ONS and BoE data

The ILC-UK says that whilst many commentators have been fixated on low interest rates in the UK, countries across the developed world are experiencing falling interest rates, reflecting a trend stemming from way before the 2008 crisis and subsequent unconventional central banking activity.

The paper also warns that while few things are certain, barring a world war or a sudden pandemic, global populations will continue to age rapidly; given that growth amongst the older population is related to lower levels of inflation, or even deflation, this would imply that interest rates are likely to decline over time.

The ILC-UK is an independent, non-partisan think-tank dedicated to addressing issues of longevity, ageing and population change.

Ben Franklin, head of economics of ageing, ILC-UK said: “Central banks are at the limit of their powers. The critical question is not whether what central banks such as the Bank of England have done is appropriate, but what else could be done to help stimulate long-term productivity whilst ensuring that they have sufficient room to manoeuvre should a recession loom large once again.”