The Exeter has revealed that the average age of a claimant on its Income Protection Plus products was 34 years old in 2019.

The health and protection insurance provider said this highlighted the importance of younger generations safeguarding their income if they are unable to work.

The figures also show that the average length of claim was 60 weeks across the 1,367 members that the Exeter supported last year while they were unable to work due to illness and injury. The mutual insurer paid out 91% of its Income Protection (IP) claims with an average claim amount of £3,920.

Accidents and injuries accounted for nearly half of claims (46%), followed by claims from those with musculoskeletal conditions (17%). Mental health conditions and common infections, such as coughs and colds, accounted for a further 18% of IP claims last year.

The introduction of digital claim forms reduced the time taken for members to complete and return claims information. In 2019, 50% of digital forms were fully completed and returned within 48 hours.

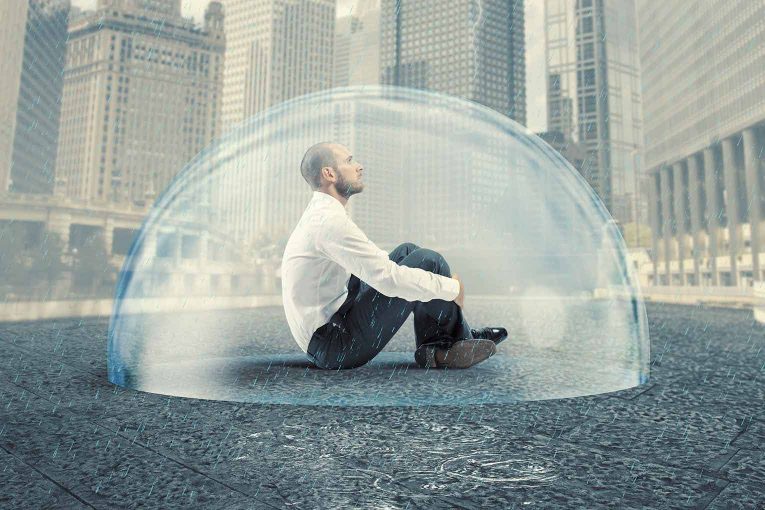

Chris Pollard, chief operating officer at the Exeter, said: “Our experience shows an increasing number of younger people are claiming on their income protection policy. Many of us might be guilty of the ‘it will never happen to me’ thought, however recent events and our evidence shows we never know what is around the corner. A shock to income due to an unexpected change in circumstances can have a devastating impact.

“Advisers remain vital in promoting and discussing with clients the importance of considering income protection from the very start of their working lives.”