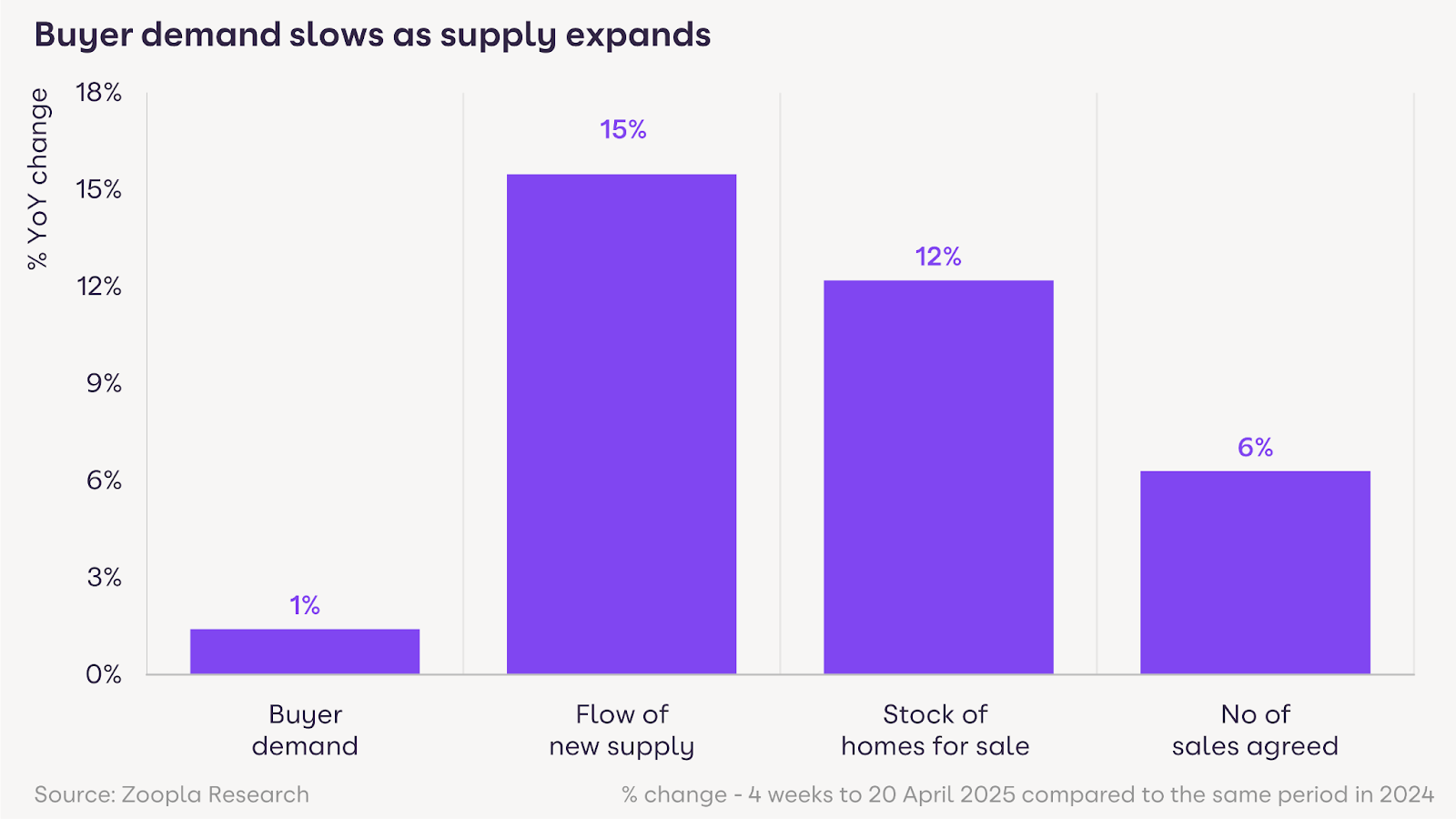

House price growth is losing momentum as buyer demand eases and the number of homes for sale reaches new heights – yet the number of sales agreed continues to rise, according to the latest Zoopla House Price Index.

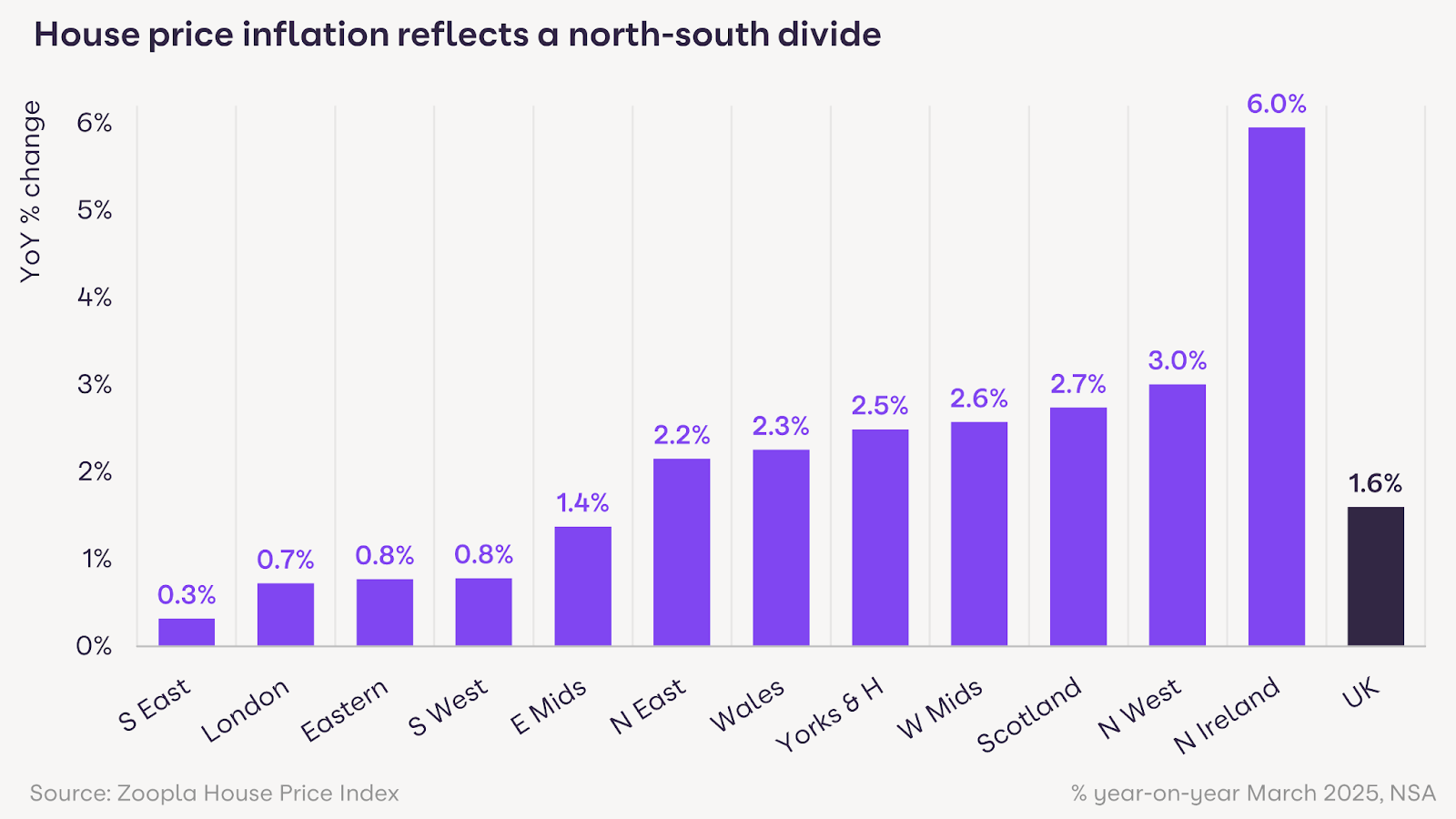

Average UK house prices rose by 1.6% in the 12 months to March 2025, down from 1.9% at the end of 2024.

However, growth remains significantly higher than the 0.2% recorded a year ago. The average property price now stands at £268,000, representing an annual increase of £4,270.

The end of stamp duty reliefs and a seasonal slowdown over Easter have softened buyer demand, now just 1% higher than a year ago compared with a 10% rise earlier this year.

Growing caution linked to the potential impact of new US tariffs on global economic growth has also influenced buyer sentiment.

Despite this, sales activity remains resilient. There are currently 12% more homes available for sale compared to a year ago, and sales agreed have increased by 6%.

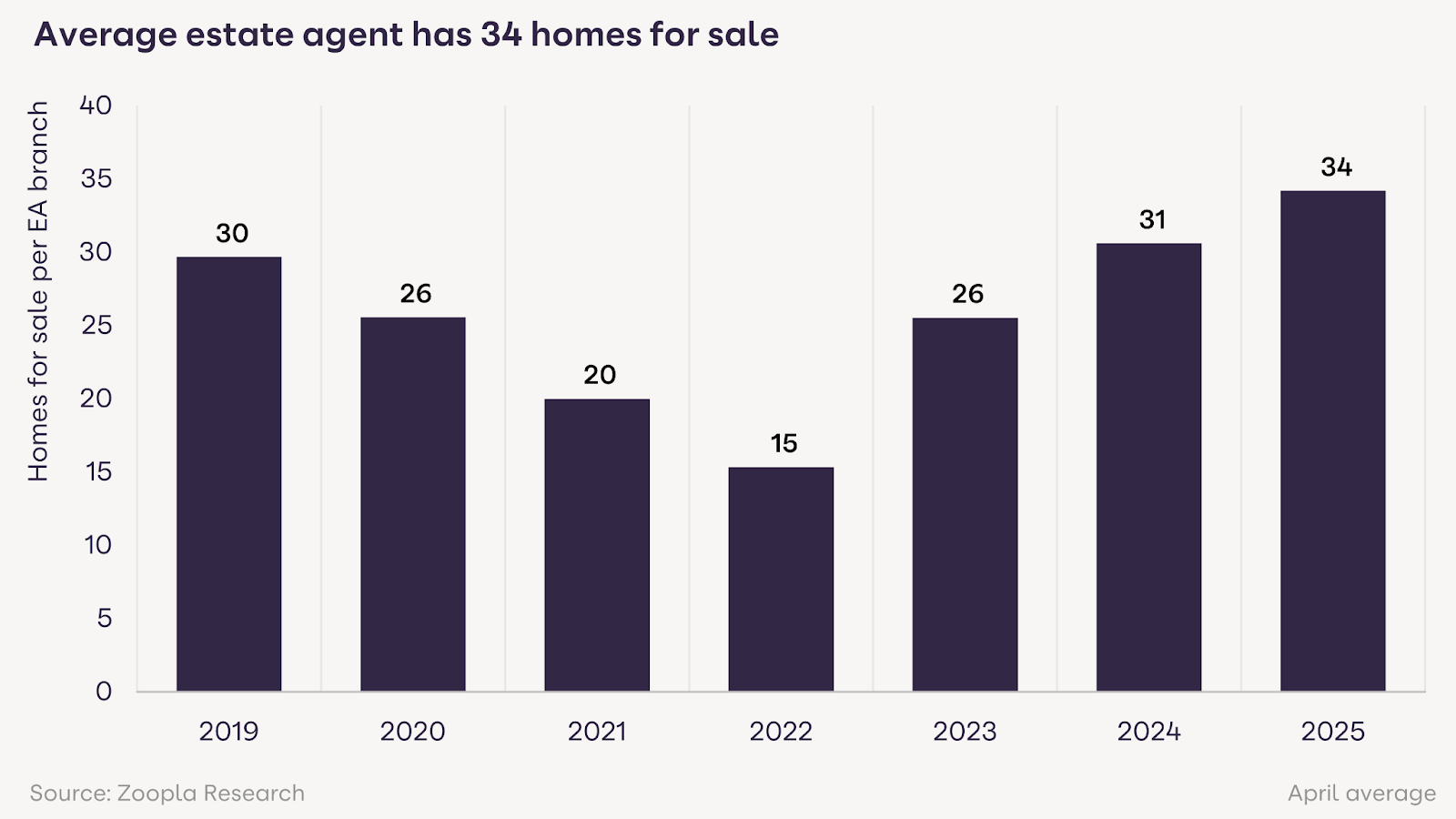

The average estate agency branch is now marketing 34 homes, up from 31 a year ago and well above the pandemic low of 15. Many sellers are also active buyers, helping to drive transaction volumes.

Looking ahead, house price growth is expected to slow further, while the number of sales agreed is likely to continue rising, supported by more attractive mortgage terms and improved buyer affordability.

LENDERS EASE AFFORDABILITY TESTS

While broader economic uncertainty remains, expectations of lower interest rates throughout 2025 are stabilising mortgage rates, with many lenders beginning to reassess how they calculate affordability.

Currently, although the average 5-year fixed rate mortgage sits at around 4.5%, many lenders continue to ‘stress test’ applicants at rates between 8% and 9%, significantly limiting the amount buyers can borrow without a large deposit.

For instance, a first-time buyer paying £1,020 per month at a 4.5% mortgage rate must typically demonstrate affordability for repayments of £1,550 per month at an 8.5% stress rate. If lenders move stress tests back to 6.5% – where they were before 2022 – the required stress-tested repayment would fall to £1,275 per month.

This change could increase borrowing capacity by more than 15%, providing a much-needed boost to buyer demand and helping to absorb the growing supply of homes on the market. Existing homeowners looking to move with a mortgage would also benefit from these revisions.

REGIONAL HOTSPOTS

While house price growth is slowing across all UK regions, several areas are bucking the trend.

Prices are increasing at a faster rate – between 2.2% and 3% annually – across the West Midlands, Northern regions, Wales, and Scotland. Northern Ireland leads with a 6% rise. These regions are also seeing a marked increase in market activity, with sales agreed up by 14% in Wales and 10% in both the North West and North East.

With more affordable house prices relative to incomes, these areas offer greater accessibility for a wider range of buyers, helping to drive momentum even as overall affordability pressures persist.

Conversely, growth in southern England – where property prices remain high relative to earnings – has slowed to below 1%. Stretched affordability and the lingering effects of the pandemic-era stamp duty holiday continue to weigh on buyer activity in these markets.

REALISTIC SELLERS

Richard Donnell, Executive Director at Zoopla, said: “The housing market continues to benefit from sellers listing their homes, supporting an ongoing increase in sales volumes. This reflects a core group of determined movers who remain active despite economic uncertainty.

“While house price growth is set to slow further, towards 1% to 1.5%, we still expect a 5% uplift in sales volumes during 2025 – provided sellers stay pragmatic on pricing. Regions where affordability aligns better with local incomes, particularly across the North and Midlands, are likely to lead this recovery.”

Donnell also highlighted the importance of recent changes in lender policy.

“One of the biggest supports to continued market activity lies with mortgage lenders,” he added. “Revisions to affordability assessments will unlock additional buying power and support sales volumes, helping to clear the healthy stock of homes for sale.”

STABLE MARKET

Martin Fishwick, Senior Partner at leading North West agency Jordan Fishwick, said: “After an extraordinary March, where many buyers and solicitors were anxious to complete purchases ahead of stamp duty increases, the market has inevitably calmed somewhat in the North West.

“However, momentum remains, driven by significant rent rises and more attractive mortgage rates.

“We tend to see a more consistent market in the North West compared with the sharp peaks and troughs experienced in London and the South East. Despite broader financial uncertainty, we remain cautiously optimistic that house prices may still see modest growth through 2025 and into 2026.”